What is Market Capitalization ?

Market capitalization

It told us about the size of the company. in other words, how much money you should have to pay to buy that company excluding cash, debt, assets, and liabilities of that company. it is called market capitalization.

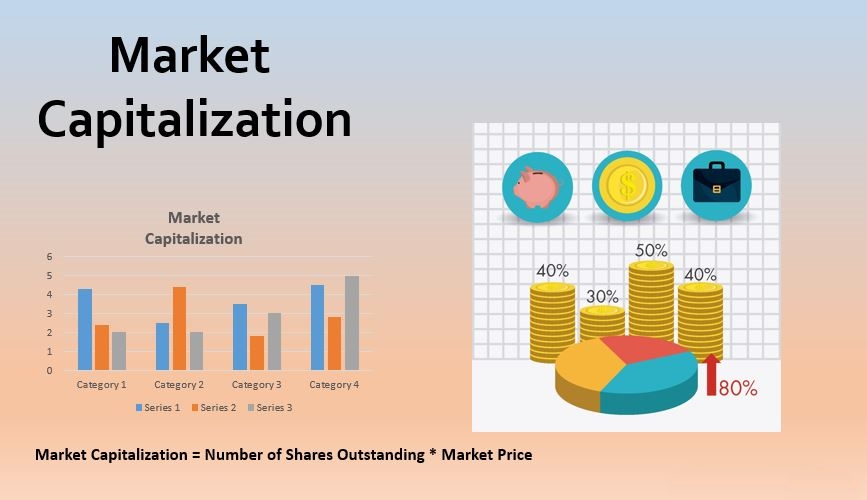

Market capitalization: No. of shares multiply the price of one share.

We have four types of companies in the market, these are as follows:

- Small-capitalization companies

- Middle capitalization companies

- Large capitalization companies

- Penny stock

These categories are depended upon the market capitalization. We can able to know that the company is large capitalization, middle capitalization, small capitalization, or penny stocks.

Let say a company ABC has 1,20,000,000 shares and price of one share is Rs.500 then,

Market cap. = 500 X 1,20,000,000 = 6000 crores

Question 1: The market capitalization of company ABC is 6000 crores, so which type of company is this?

Range –

Small-cap. – Market cap. below 14000 crores are known as small-cap. companies.

Middle cap. – Market cap. between 14000 crores to 18000 crores are middle cap. companies.

Large-cap. – Market cap. greater than 18000 crores are large-cap. companies.

Penny stocks – Market cap. below 100 crores and share price below Rs.20-30 are penny stocks.

Answer 1 – Market cap. of company, ABC is 6000 crores that means this is a small-cap. company.

Questions 2 – Why penny stocks are risky?

Answer 2 – The companies are in the category of penny stock are mainly near to bankruptcy or they don’t have growth, some of the penny stocks have illegal charges and court cases also they don’t have a backup for a company like for recession and crisis.

For example – Most penny stocks companies might close during coronavirus crisis because they don’t have a backup for this type of situation.

But also remember one thing few companies in penny stock might be good but you have to do a great analysis to find it otherwise I recommend you stay away from this category.

About Corona Virus Effect in Market,Stock Market

A mindset of new retail investor

Many of the new investors don’t have a big amount to invest so they think if they buy penny stock so they will have too many shares and if the Rs.1 share will become Rs.2 shares then they will get a double return but most of the times it won’t happen. So, don’t do this.

Large-cap. companies

These companies also called blue-chip companies with a very high market cap. like greater than 18000 crores. They are the most stable companies with a big brand name like the Reliance industry, State bank of India, HDFC Bank, TCS, etc. they also have a backup for recession and crisis. They are known for safe investments.

Note: If a company is large-cap. that does not mean the company will give you a good return you must do further analysis to make sure the company is worthy of investment.

Small-cap. companies

These are small companies with a market cap. below than 14000 crores. Small-cap. companies have both factors in high amount –

1) Growth opportunities

2) Failure rate

These companies also don’t have much backup for bad times, you should analyze a company deeply if it is a small-cap. company.

Note: Sometimes it doesn’t matter that the company is a small cap., middle cap. or large-cap. there are a lot of companies have high growth opportunities and low-risk factor you just have to do a deep analyze.

“Investment is all about risk management. It’s not about risk-taking, it’s about risk management”.

If you like our work so please share this with your friends and family and also follow us on Instagram and Twitter and support us by improving yourself.

Thanks for reading.

+ There are no comments

Add yours